Obtaining a CPA license in Mississippi requires that you meet a number of requirements. You will need to have completed at least 150 semester credits at a college, passed the CPA exam and gained at least one full year of supervised accountancy experience. These requirements are unique to the Mississippi State Board of Public Accountancy. A complete list of these requirements can be found on the website of the state board.

Mississippi's CPA exam tests your writing and oral communication skills, as well as your knowledge of business. To pass the exam, you will need to complete a number of courses. Additionally, you will need to complete a background investigation. An exemption may be granted if you are physically disabled and unable to sit for the exam.

CPE (Continuing Professional Training) is also required by the state board. The state board requires that you have at least 40 hours of CPE each year. You may also carry over 20 hours from one year to another. To assist you in keeping track of your CPE, the board will issue a Continuing Personal Education Reporting Formula. These hours must be submitted by December 31st of each year. In the case of a natural catastrophe, you may be granted extensions.

Mississippi State Board of Public Accountancy also requires candidates to pass the Uniform CPA Exam. The exam can only be taken online by candidates who have fulfilled the education requirements. Candidates can choose to either study online or take a class.

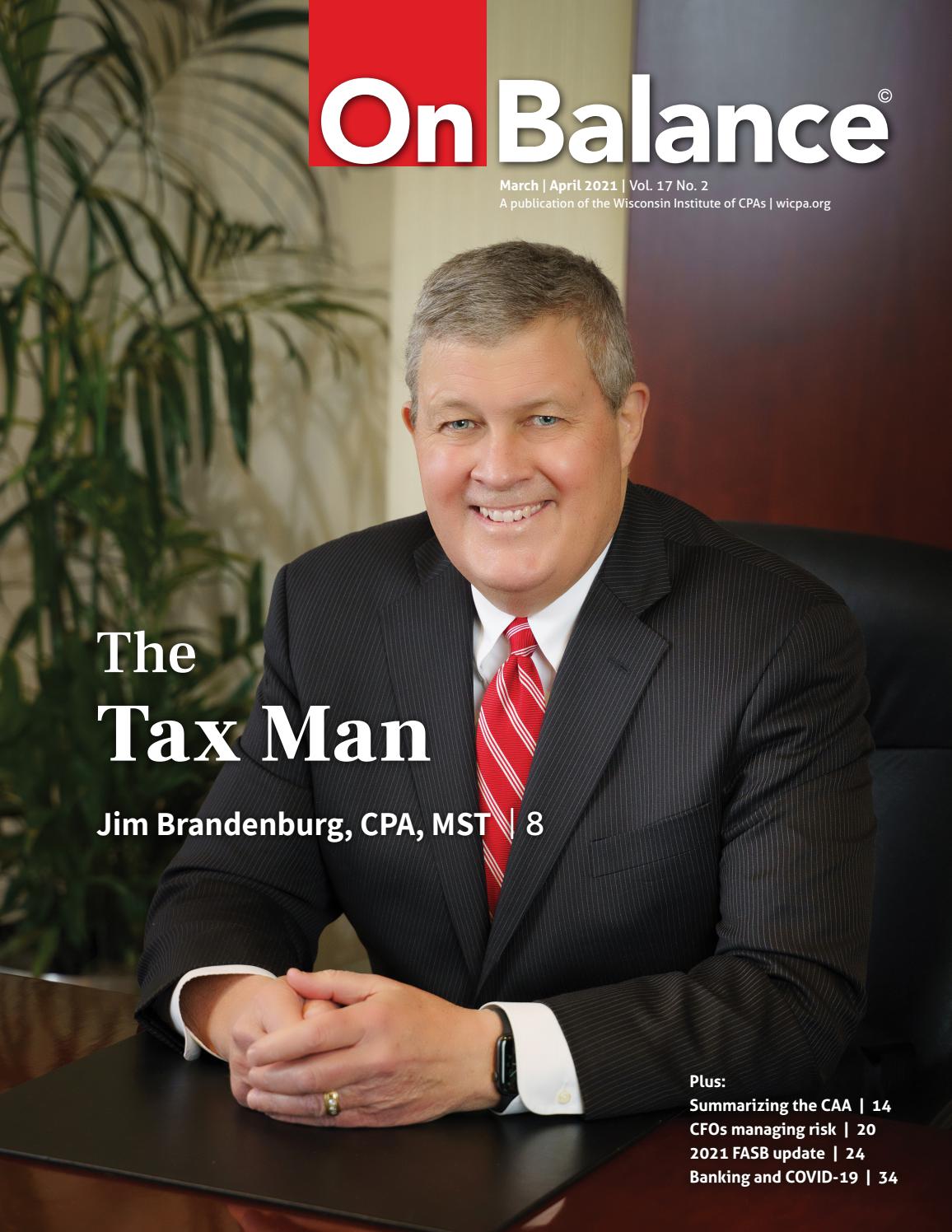

The AICPA is the national professional group for CPAs. The organization provides networking opportunities, educational resources, and development programs. They also offer a student member. Students can join the AICPA to help prepare for the CPA exam.

You can get a Mississippi CPA licence to help you begin a rewarding career in accounting. Mississippi residents are required for licensure. Also, you will need to earn a bachelor's in accounting and have at most one year of supervised accounting experience. A CPA license in Mississippi can open up many career options.

In addition to meeting the requirements for a CPA license, you should also consider joining the Mississippi Society of Certified Public Accountants (MSCPA). The MSCPA represents the state's only professional organization for CPAs. MSCPA members have the opportunity to specialize in areas like auditing or finance. MSCPA members may also benefit from the organization's development opportunities.

The Mississippi State Board of Public Accountancy has responsibility for administering and licensing CPAs. It is recommended that your application for your license be made at least six months in advance of taking the exam. You should also take advantage of the state's reciprocity program if you plan on moving to Mississippi. The board can help you learn more about Mississippi's CPA licensing requirements and exams.

FAQ

What are the types of bookkeeping software?

There are three main types of bookkeeping systems: manual, computerized and hybrid.

Manual bookkeeping refers to the use of pen & paper to record records. This method requires constant attention.

Software programs are used for computerized bookkeeping to manage finances. It saves time and effort.

Hybrid bookkeeping uses both manual and computerized methods.

What is bookkeeping and how do you define it?

Bookkeeping refers to the process of keeping financial records for individuals, companies, or organizations. It involves recording all business-related income as well as expenses.

All financial information is kept track by bookkeepers. These include receipts. Invoices. Bills. Payments. Deposits. Interest earned on investments. They also prepare tax returns as well other reports.

What happens if my bank statement isn't reconciled?

If you fail to reconcile your bank statement, you may not realize that you've made a mistake until after the end of the month.

At this point, you will need repeat the entire process.

What is an accountant and why are they so important?

An accountant keeps track all the money that you earn and spend. They keep track of how much tax is paid and allowable deductions.

An accountant can help you manage your finances and keep track of your incomes and expenses.

They can prepare financial reports both for individuals and companies.

Accountants are needed because they have to know everything about the numbers.

Accountants also assist people with filing taxes to ensure that they are paying as little tax possible.

What are the benefits of accounting and bookkeeping?

Bookkeeping and accounting is essential for any business. They allow you to keep track of all transactions and expenses.

They can also help you avoid spending too much on unnecessary things.

You must know how much profit each sale has brought in. You will also need to know who you owe.

If you don't have enough money coming in, then you might want to try raising prices. You might lose customers if you raise prices too much.

You may be able to sell some inventory if you have more than what you need.

You can reduce the number of products or services you use if you have less money.

All these things will affect your bottom line.

What training do you need to become a bookkeeper

Basic math skills are necessary for bookkeepers. They need to be able to add, subtract, multiply, divide, fractions and percentages.

They will also need to be able use a computer.

The majority of bookkeepers have a high-school diploma. Some may even hold a college degree.

What is the difference between accounting and bookkeeping?

Accounting is the study and analysis of financial transactions. These transactions are recorded in bookkeeping.

These two activities are closely related, but distinct.

Accounting deals primarily on numbers, while bookkeeping deals mostly with people.

For reporting purposes on an organization's financial condition, bookkeepers keep financial records.

They adjust entries in accounts receivable and accounts payable to make sure that the books balance.

Accountants review financial statements to determine compliance with generally accepted Accounting Principles (GAAP).

They might recommend changes to GAAP, if not.

For accountants to be able to analyze the data, bookkeepers must keep track of financial transactions.

Statistics

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

Accounting: The Best Way

Accounting is a process and procedure that allows businesses track and record transactions accurately. It includes recording income, expense, keeping records sales revenue and expenditures as well as creating financial statements and analyzing data.

This includes reporting financial results to investors, shareholders, lenders, customers, and other stakeholders.

There are many ways to do accounting. Some examples are:

-

Create spreadsheets manually

-

Excel software.

-

Notes on paper for handwriting

-

Use computerized accounting systems.

-

Online accounting services.

There are many ways to do accounting. Each method has both advantages and disadvantages. The choice of which one to use depends on your business model. Before you choose any method, it is important to weigh the pros and cons.

Accounting can not only be more efficient, but there may also be other reasons to use it. If you're self-employed, for example, it might be a good idea to keep accurate books as they can provide proof of your work. You might prefer simple accounting methods if your business is small or does not have large financial resources. Complex accounting is better if your company generates large cash flows.