If you're trying to figure out which accounting method is best for your business, you should learn about the differences between cash-basis and accrual accounts. Cash-basis accounts are simpler, require less work and provide a clearer picture on your income and expenditures. Accrual accounts however allow for more accuracy.

Cash-basis accounting is simpler

Cash-basis accounting takes less time to grasp than accrual. It requires fewer records to track and less monitoring of bank funds. This means that the learning curve for this system is shorter. It does not require extensive planning or a detailed breakdown income and expenses. However, it is not able to provide an overall picture of the company's financial health. Cash-basis accounting is therefore not suitable for all businesses.

Both methods have their advantages and disadvantages. Cash-basis is more straightforward to use but not as comprehensive as accrual. The main difference is in the timing. Simple is best for small businesses. But when a business gets larger, it may benefit from a more comprehensive approach. A certified public accountant can help you choose the best approach.

There is one key difference between cash-basis or accrual accounting: how revenue and expenses will be recorded. Accrual accounting records revenues and expenses as they occur. Cash-basis accounting records line item payments and receipts. Because this method focuses on the actual payments and expenses and not future obligations, financial planning is easier.

It requires less effort

Your business determines whether to use accrual accounting or cash accounting. Small businesses tend to prefer cash accounting as it lets them track how much money they have coming in and going out. The IRS requires accrual accounting for all businesses with inventory. A business that earns more than $10,000,000 must change to accrual accounting. Before you make the switch, consult an accountant or a bookkeeper to understand your options.

The benefit of using the accrual method is that it gives you a more accurate picture of your business's financial position because it records income as it is earned and expenses when they are incurred. This allows you to easily compare income with expenses and calculate your net profit. The accrual method is required by almost every business with inventory, including wholesale, manufacturing, and retail. Service businesses are often required to have inventory in order to charge for parts.

FAQ

What exactly is bookkeeping?

Bookkeeping is the practice of maintaining records of financial transactions for businesses, organizations, individuals, etc. It includes recording all business-related expenses and income.

All financial information is tracked by bookkeepers. This includes receipts, bills, invoices and payments. They also prepare tax returns and other reports.

How do I start keeping books?

For you to begin keeping your books, you'll need a few things. These are a notebook with a pencil, calculator, printer and stapler.

What are the types of bookkeeping software?

There are three main types of bookkeeping systems: manual, computerized and hybrid.

Manual bookkeeping involves using pen and paper for records. This method requires constant attention to detail.

Computerized bookkeeping is a way to keep track of finances using software programs. It saves time and effort.

Hybrid Bookkeeping is a hybrid of manual and computerized methods.

Do accountants get paid?

Yes, accountants usually get paid hourly rates.

Accounting firms may charge an additional fee to prepare complex financial statements.

Sometimes accountants may be hired to perform specific tasks. An example of this is a public relations firm that might hire an accountant for a report on how the client is doing.

What does an auditor do exactly?

Auditors look for inconsistencies in financial statements and actual events.

He checks the accuracy of the figures provided by the company.

He also verifies the validity of the company's financial statements.

Statistics

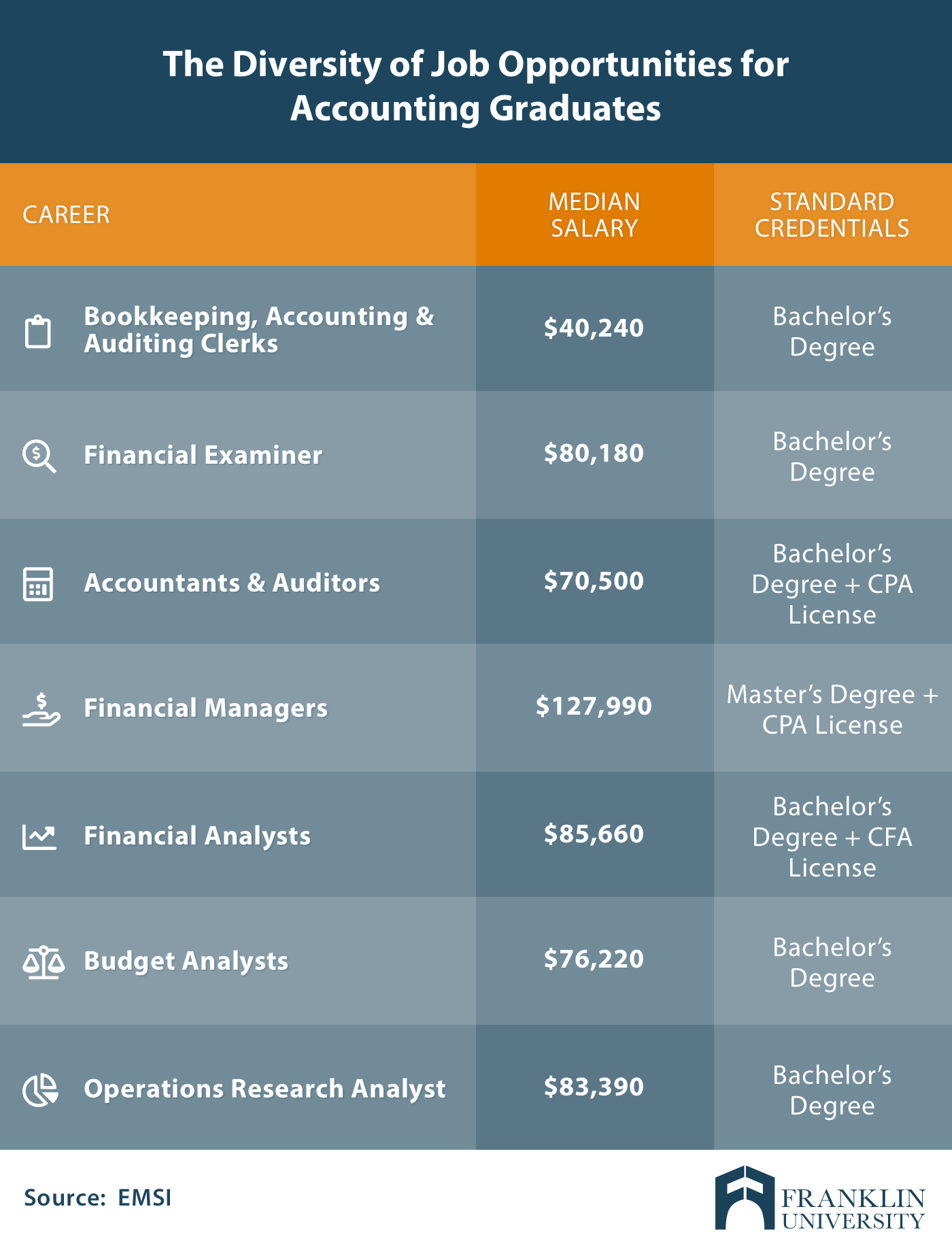

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

Accounting for Small Businesses: What to Do

Accounting for small businesses should be one of your most important tasks when managing a business. This involves tracking income and expenses as well as preparing financial reports and tax payments. This task also requires the use of software programs, such as Quickbooks Online. There are several ways to do small business accounting. You should choose the best way for you according to your needs. Below is a list of top methods that we recommend.

-

Use paper accounting. Paper accounting is a good option if you prefer simplicity. It is easy to use this method. All you have to do is record your transactions every day. An accounting program such as QuickBooks Online can help you ensure your records are accurate.

-

Online accounting. Online accounting is a way to have easy access to your accounts no matter where you are. Some popular options include Xero, Freshbooks, and Wave Systems. These software allows you to manage your finances and generate reports. They offer great features and benefits, and they are easy to use. So if you want to save time and money when it comes to accounting, you should definitely try out these programs.

-

Use cloud accounting. Another option is cloud accounting. It allows data to be securely stored on a remote server. When compared to traditional accounting systems, cloud accounting has several advantages. It doesn't require you to purchase expensive hardware or software. It offers greater security as all of your data is stored remotely. It takes the worry out of backups. Fourth, it makes sharing files easier.

-

Use bookkeeping software. Bookkeeping software is similar with cloud accounting. However you must purchase a computer in order to install the software. After installing the software, you will be able to connect to the internet so that you can access your accounts whenever you want. In addition, you will be able to view your accounts and balance sheets directly through your PC.

-

Use spreadsheets. Spreadsheets are useful for entering financial transactions manually. You can, for example, create a spreadsheet that allows you to enter sales figures each day. Another benefit of using a spreadsheet is the ability to make changes at will without needing an entire update.

-

Use a cash book. A cashbook is a ledger where you write down every transaction that you perform. There are many sizes and shapes of cashbooks, depending on the space available. You can either keep separate notebooks for each month or one that spans several months.

-

Use a check register. Use a check register to keep track of receipts and pay bills. Once you have scanned the items, you can transfer them into your check register. To help you remember what was bought, you can make notes once you have scanned the items.

-

Use a journal. A journal is a logbook which keeps track of your expenses. This is especially useful if you have frequent recurring expenses such rent, utilities, and insurance.

-

Use a diary. Use a diary. It is simply a notebook that you keep for yourself. You can use it for tracking your spending habits or planning your budget.